Financial Markets and Valuation MGNT808

Tutorial 2, Week 2

Homework questions.

Katya offers to pay you $10 at the end of every year for the next 5 years (t=1,2,3,4,5) if you pay her $50 now (t=0). You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate. Ignore credit risk.

Paying $50 to Katya now in exchange for receiving $10 at the end of each year for 5 years might seem like a fair deal since ##5 \times 10 = 50##, but it's not. Katya is proposing an unfair deal that benefits her at your expense.

An amount of $50 now is worth more than 5 payments of $10 over 5 years since Katya can put your $50 payment in the bank, pay you $10 at the end of the first year, and keep the $5 ##(=0.1\times 50)## interest earned on the $50 for herself. In the second year, she starts with $45 ##(=50+5-10)## in the bank, and she receives 4.5 ##(=0.1\times 45)## interest that she can keep for herself, and so on.

To find the value of the deal to you right now, we find the present value using the annuity equation. The cash flows received are positive and the cash flows paid are negative.

###\begin{aligned} V_0 &= C_0 + \frac{C_{1,2...T}}{r} \left( 1-\frac{1}{(1+r)^T} \right) \\ &= -50 + \frac{10}{0.1} \left( 1-\frac{1}{(1+0.1)^5} \right) \\ &= -50 + 37.90786769 \\ &= -12.092132306 \\ \end{aligned}###

Therefore, accepting the deal would reduce your current wealth by $12.09, and increase Katya's current wealth by $12.09.

This annuity formula ##\dfrac{C_1}{r}\left(1-\dfrac{1}{(1+r)^3} \right)## is equivalent to which of the following formulas? Note the 3.

In the below formulas, ##C_t## is a cash flow at time t. All of the cash flows are equal, but paid at different times.

The annuity formula with T cash flows sums the present value of each, where the first is at time 1 and the last at time T:

###\dfrac{C}{r}\left(1-\dfrac{1}{(1+r)^T} \right) = \dfrac{C_1}{(1+r)^1} +\dfrac{C_2}{(1+r)^2} + ... + \dfrac{C_T}{(1+r)^T} ###The annuity formula with 3 cash flows sums the present value of each, where the first is at time 1 and the last at time 3:

###\dfrac{C}{r}\left(1-\dfrac{1}{(1+r)^3} \right) = \dfrac{C_1}{(1+r)^1} +\dfrac{C_2}{(1+r)^2} + \dfrac{C_3}{(1+r)^3} ###There are many ways to write the ordinary annuity formula.

Which of the following is NOT equal to the ordinary annuity formula?

All answers are mathematically equivalent except (e).

The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

We will use the annuity equation and the present value of a single cash flow equation. Keep in mind that the annuity equation gives a value that is one period before the first cash flow at t=3, so the value of the annuity will be at t=2 and needs discounting by 2 periods to get to t=0.

###\begin{aligned} V_{0} &= \dfrac{C_{3} \times \dfrac{1}{r_\text{eff annual}} \left(1 - \dfrac{1}{(1+r_\text{eff annual})^{10}} \right)}{(1+r_\text{eff annual})^2} + \dfrac{C_{5.5}}{(1+r_\text{eff annual})^{5.5}} \\ &= \dfrac{60 \times \dfrac{1}{0.1} \left(1 - \dfrac{1}{(1+0.1)^{10}} \right)}{(1+0.1)^2} + \dfrac{400}{(1+0.1)^{5.5}} \\ &= \dfrac{60 \times 6.144567106}{(1+0.1)^2} + \dfrac{400}{(1+0.1)^{5.5}} \\ &= 304.689278 + 236.810101 \\ &= 541.4993789 \\ \end{aligned} ###Question 58 NPV, inflation, real and nominal returns and cash flows, Annuity

A project to build a toll bridge will take two years to complete, costing three payments of $100 million at the start of each year for the next three years, that is at t=0, 1 and 2.

After completion, the toll bridge will yield a constant $50 million at the end of each year for the next 10 years. So the first payment will be at t=3 and the last at t=12. After the last payment at t=12, the bridge will be given to the government.

The required return of the project is 21% pa given as an effective annual nominal rate.

All cash flows are real and the expected inflation rate is 10% pa given as an effective annual rate. Ignore taxes.

The Net Present Value is:

Since the cash flows are real but our discount rate is nominal, we need to convert the nominal discount rate to a real rate. Using the exact Fisher equation,

###\begin{aligned} 1+r_\text{real} &= \frac{1+r_\text{nomimal}}{1+r_\text{inflation}} \\ r_\text{real} &= \frac{1+r_\text{nomimal}}{1+r_\text{inflation}} -1 \\ &= \frac{1+0.21}{1+0.1} -1 \\ &= 0.1 \\ \end{aligned} ###

Now just discount the cash flows using two annuity equations.

###\begin{aligned} V_0 &= -C_\text{0, 1, 2}.\frac{1}{r}\left(1 - \frac{1}{(1+r)^{3}} \right).(1+r)^{1} + C_\text{3, 4, ..., 12}.\frac{1}{r}\left(1 - \frac{1}{(1+r)^{10}} \right).\frac{1}{(1+r)^{2}} \\ &= -100m \times \frac{1}{0.1} \times \left(1 - \frac{1}{(1+0.1)^{3}} \right) \times (1+0.1)^{1} + 50m \times \frac{1}{0.1} \times \left(1 - \frac{1}{(1+0.1)^{10}} \right) \times \frac{1}{(1+0.1)^{2}} \\ &= -100m \times 2.48685199 \times 1.1 + 50m \times 6.14456711 \times 0.82644628 \\ &= -273.553719m + 253.9077316m \\ &= -19.64598737m \\ &= -19,645,987.37 \\ \end{aligned} ###

Your friend overheard that you need some cash and asks if you would like to borrow some money. She can lend you $5,000 now (t=0), and in return she wants you to pay her back $1,000 in two years (t=2) and every year after that for the next 5 years, so there will be 6 payments of $1,000 from t=2 to t=7 inclusive.

What is the net present value (NPV) of borrowing from your friend?

Assume that banks loan funds at interest rates of 10% pa, given as an effective annual rate.

The annuity formula can be applied to find the present value of the 6 equal payments from t=2 to 7. But care must be taken since the present value of an annuity is one period before the first cash flow (at t=2), so the whole annuity value will be at t=1 so it needs to be discounted back one extra period to get a present value.

###\begin{aligned} V_0 &= C_0 - \dfrac{ C_2.\dfrac{1}{r}\left( 1-\dfrac{1}{(1+r)^6} \right) }{(1+r)^1} \\ &= 5,000 - \dfrac{ 1,000 \times \dfrac{1}{0.1}\left( 1-\dfrac{1}{(1+0.1)^6} \right) }{(1+0.1)^1} \\ &= 5,000 - 3,959.3279 \\ &= 1,040.6721 \\ \end{aligned}###Telsa Motors advertises that its Model S electric car saves $570 per month in fuel costs. Assume that Tesla cars last for 10 years, fuel and electricity costs remain the same, and savings are made at the end of each month with the first saving of $570 in one month from now.

The effective annual interest rate is 15.8%, and the effective monthly interest rate is 1.23%. What is the present value of the savings?

The annuity formula is perfectly suited to this problem since the payments are all equal. Since the first cash flow is exactly one month away, the annuity equation will give a present value one month before that which is at time zero. Perfect.

###\begin{aligned} V_0 &= \frac{C_{1}}{r} \left( 1-\frac{1}{(1+r)^T} \right) \\ V_0 &= \frac{C_\text{1 monthly}}{r_\text{eff monthly}} \left( 1-\frac{1}{(1+r_\text{eff monthly})^{T_\text{months}}} \right) \\ &= \frac{570}{0.0123} \left( 1-\frac{1}{(1+0.0123)^{10 \times 12}} \right) \\ &= 35,654.3278 \\ \end{aligned}###The present value of an annuity of 3 annual payments of $5,000 in arrears (at the end of each year) is $12,434.26 when interest rates are 10% pa compounding annually.

If the same amount of $12,434.26 is put in the bank at the same interest rate of 10% pa compounded annually and the same cash flow of $5,000 is withdrawn at the end of every year, how much money will be in the bank in 3 years, just after that third $5,000 payment is withdrawn?

There will be nothing left in the bank account since the three $5,000 payments in one year, two years and three years are exactly equivalent to $12,434.26 now when interest rates are 10% pa. So the annuity of 3 payments of $5,000, which are negative cash flows, will exactly offset the $12,434.26 asset value at the very start such that the net present value (NPV) is zero:

###\begin{aligned} NPV &= V_0 - C_1 \times \dfrac{1}{r} \left(1- \dfrac{1}{(1+r)^T} \right) \\ &= 12,434.26 - 5,000 \times \dfrac{1}{0.1} \left(1- \dfrac{1}{(1+0.1)^3} \right) \\ &= 12,434.26 - 5,000 \times 2.48685199098 \\ &= 12,434.26 - 12,434.26 \\ &= 0 \\ \end{aligned}###Another way to show that there will be nothing left is to:

- Grow the $12,434.26 now by one year since it will accrue interest in the bank at 10% pa: ###V_{1\text{, just before payment}}=12,434.26(1+0.1)^1 = 13,677.686###

- Then subtract the $5,000 payment at the end of year one: ###V_{1\text{, just after payment}} =13,677.686 - 5,000 = 8,677.686###

- Then grow what remains out to the second year: ###V_{2\text{, just before payment}}=8,677.686*(1+0.1)^1 = 9,545.4546###

- Then subtract the $5,000 payment at the end of the second year: ###V_{2\text{, just after payment}}=9,545.4546 - 5,000 = 4,545.4546###

- Then grow what remains out to the third year: ###V_{3\text{, just before payment}}=4,545.4546*(1+0.1)^1 = 5,000###

- This is just enough to afford the final payment of $5,000 at the end of the third year! ###V_{3\text{, just after payment}}=5,000 - 5,000 = 0###

In summary:

###\begin{aligned} V_{3\text{, just after payment}} &= ((V_0(1+r)^1 - C_1)(1+r)^1 - C_2)(1+r)^1 - C_3 \\ &= ((12,434.26(1+0.1)^1 - 5,000)(1+0.1)^1 - 5,000)(1+0.1)^1 - 5,000 \\ &= 0 \\ \end{aligned}###Some countries' interest rates are so low that they're zero.

If interest rates are 0% pa and are expected to stay at that level for the foreseeable future, what is the most that you would be prepared to pay a bank now if it offered to pay you $10 at the end of every year for the next 5 years?

In other words, what is the present value of five $10 payments at time 1, 2, 3, 4 and 5 if interest rates are 0% pa?

When the yield is zero, there is no time value of money. Therefore we can just sum cash flows like an accountant.

###\begin{aligned} V_0 &= T \times C \\ &= 5 \times 10 = 50 \\ \end{aligned}###

Interestingly, the normal way to value an annuity with the annuity equation will not work since there will be a divide by zero problem which is mathematically impossible:

###\begin{aligned} V_0 &= C_\text{1} \times \frac{1}{r_\text{eff yrly}} \left( 1 - \frac{1}{(1+r_\text{eff yrly})^{T}} \right) \\ &= 1 \times \color{red}{\frac{1}{0}} \left( 1 - \frac{1}{(1+0)^{5}} \right) \\ \end{aligned}###

Since 1/0 is mathematically undefined, that is a dead-end.

But present-valuing the individual payments separately will still work.

###\begin{aligned} P_0 &= \frac{C_\text{1 yr}}{(1+r_\text{eff yrly})^1} + \frac{C_\text{2 yr}}{(1+r_\text{eff yrly})^2} + \frac{C_\text{3 yr}}{(1+r_\text{eff yrly})^3} + \frac{C_\text{4 yr}}{(1+r_\text{eff yrly})^4} +\frac{C_\text{5 yr}}{(1+r_\text{eff yrly})^5} \\ &= \frac{10}{(1+0)^1} + \frac{10}{(1+0)^2} + \frac{10}{(1+0)^3} + \frac{10}{(1+0)^4} +\frac{10}{(1+0)^5} \\ &= 10+10+10+10+10 \\ &= 5 \times 10 \\ &= 50 \\ \end{aligned}###

The first payment of a constant perpetual annual cash flow is received at time 5. Let this cash flow be ##C_5## and the required return be ##r##.

So there will be equal annual cash flows at time 5, 6, 7 and so on forever, and all of the cash flows will be equal so ##C_5 = C_6 = C_7 = ...##

When the perpetuity formula is used to value this stream of cash flows, it will give a value (V) at time:

The perpetuity equation gives a value one period before the first cash flow.

###V_{t-1} = \dfrac{C_t}{r} ###In this question the first cash flow is at time 5, and there's a one year period between each cash flow. So the value of the perpetuity will be at time 4, one year before time 5.

###V_4 = \dfrac{C_5}{r} ###A stock just paid its annual dividend of $9. The share price is $60. The required return of the stock is 10% pa as an effective annual rate.

What is the implied growth rate of the dividend per year?

The $9 dollar dividend just paid will not be included in the price since buying the stock now will not give the owner the right to receive that dividend since it's already paid, it's too late. The next dividend will be in one year, and it will have grown by g, so ## c_1 = 9 \times (1+g)^1## .

###p_0=\dfrac{c_1}{r-g}### ###60 = \dfrac{9 \times (1+g)^1}{0.1-g}### ###60 \times (0.1-g) = 9 \times (1+g)### ###6 - 60g = 9 + 9g### ###69g = -3### ###g = -3/69 = -0.043478261 ###Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

The perpetuity with growth equation is suitable for valuing real estate since rental payments from land last forever. Re-arranging the perpetuity with growth equation into the 'total return' equation gives:

###P_0 = \frac{C_1}{r-g} ### ###r = \frac{C_1}{P_0} + g ###The growth rate in the rental payments g must equal the capital return which is the growth rate in the house price. See question 3 for an explanation of why.

Values can now be substituted into the equation to find g which is the growth rate in income cash flows (and the capital return). The price is supposed to be the market value now ($500,000) not the historical cost book value ($300,000) years ago. The income yield is the future value of income cash flows divided by the current market price:

###r = \frac{C_1}{P_0} + g ### ###0.08 = \frac{25,027.77}{500,000} + g ### ###\begin{aligned} g &= 0.08 - \frac{25,027.77}{500,000} \\ &= 0.08 - 0.050055546 \\ &= 0.029944454 \\ \end{aligned}###The following is the Dividend Discount Model (DDM) used to price stocks:

### P_0 = \frac{d_1}{r-g} ###Assume that the assumptions of the DDM hold and that the time period is measured in years.

Which of the following is equal to the expected dividend in 3 years, ## d_3 ##?

Re-arranging the dividend discount model we can break up total return into its dividend yield and capital yield components:

###P_0 = \frac{d_1}{r-g} ### ###r-g = \frac{d_1}{P_0} ### ###r = \frac{d_1}{P_0} + g ### ###r_\text{total} = r_\text{dividend} + r_\text{capital} ###So the following expressions are all equal to the dividend yield:

###r_\text{dividend} = \frac{d_1}{P_0} = r_\text{total} - r_\text{capital} = r - g###

Therefore, starting from answer (e),

###\begin{aligned} &P_0(1+g)^2(r-g) \\ &= P_2 \times (r-g) \\ &= P_2 \times \frac{d_1}{P_0} \\ &= P_2 \times \frac{d_1 \times (1+g)^2}{P_0 \times (1+g)^2} \\ &= P_2 \times \frac{d_3}{P_2} \\ &= d_3 \\ \end{aligned} ###

Note that all of the other answers give ## d_4 ##, the dividend in year 4.

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###p_0=\frac{d_1}{r_\text{eff}-g_\text{eff}}###

Which expression is NOT equal to the expected capital return?

Answer (d) is the dividend yield minus one (which is not very useful!). All of the other expressions will be equal to the firm's capital yield which is the same as the growth rate of the stock price and also the growth rate of the dividend, provided that the assumptions of the DDM hold.

Discounted cash flow (DCF) valuation prices assets by finding the present value of the asset's future cash flows. The single cash flow, annuity, and perpetuity equations are very useful for this.

Which of the following equations is the 'perpetuity with growth' equation?

The perpetuity with growth equation is:

###V_0=\dfrac{C_1}{r-g} = \sum\limits_{t=1}^\infty \left( \dfrac{C_t.(1+g)^t}{(1+r)^t} \right) ###See the dividend discount model Wikipedia page for a derivation of how the infinite sum has a closed-form solution.

A stock is expected to pay its next dividend of $1 in one year. Future annual dividends are expected to grow by 2% pa. So the first dividend of $1 will be in one year, the year after that $1.02 (=1*(1+0.02)^1), and a year later $1.0404 (=1*(1+0.02)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

Use the perpetuity with growth formula to price the annual dividend paying stock.

###\begin{aligned} p_0 &= \dfrac{c_1}{r - g} \\ &= \dfrac{1}{0.1 - 0.02} \\ &= 12.50 \\ \end{aligned}###A stock just paid a dividend of $1. Future annual dividends are expected to grow by 2% pa. The next dividend of $1.02 (=1*(1+0.02)^1) will be in one year, and the year after that the dividend will be $1.0404 (=1*(1+0.02)^2), and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

Use the perpetuity with growth formula to price the annual dividend paying stock. But remember that the dividend at time zero was already paid, so if you purchase the share now you will not receive the dividend and therefore it is not included in the stock price, so we ignore it. Focus on the future dividends which we will receive, and the next is in one year (t=1) and will be $1.02.

###\begin{aligned} p_0 &= \dfrac{c_1}{r - g} \\ &= \dfrac{c_0(1+g)^1}{r - g} \\ &= \dfrac{1(1+0.02)^1}{0.1 - 0.02} \\ &= \dfrac{1.02}{0.08} \\ &= 12.75 \\ \end{aligned}###A stock is just about to pay a dividend of $1 tonight. Future annual dividends are expected to grow by 2% pa. The next dividend of $1 will be paid tonight, and the year after that the dividend will be $1.02 (=1*(1+0.02)^1), and a year later 1.0404 (=1*(1+0.04)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

Use the perpetuity with growth formula to price the annual dividend paying stock. But remember that the dividend at time zero is just about to be paid, so if you purchase the share now you will receive the dividend and therefore it is included in the stock price.

This immediate $1 dividend can be added separately to the perpetuity. It's a value at time zero so there's no need to discount it.

###\begin{aligned} p_0 &= c_0 + \dfrac{c_1}{r - g} \\ &= c_0 + \dfrac{c_0 (1+g)^1}{r - g} \\ &= 1+ \dfrac{1 (1+0.02)^1}{0.1 - 0.02} \\ &= 1+ 12.75 \\ &= 13.75 \\ \end{aligned}###Or, this immediate $1 dividend can be included in the perpetuity formula, but that means that the first cash flow will be at time zero and therefore the perpetuity will be at time negative one, so it needs growing forward one period to time zero.

###\begin{aligned} p_0 &= \dfrac{c_0}{r - g} \times (1+ r)^1 \\ &= \dfrac{1}{0.1 - 0.02} \times (1+0.1)^1 \\ &= 12.50 \times (1+0.1)^1 \\ &= 13.75 \\ \end{aligned}###For a price of $13, Carla will sell you a share paying a dividend of $1 in one year and every year after that forever. The required return of the stock is 10% pa.

For a price of $1040, Camille will sell you a share which just paid a dividend of $100, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##100(1+0.05)^1=$105.00##, and the year after it will be ##100(1+0.05)^2=110.25## and so on.

The required return of the stock is 15% pa.

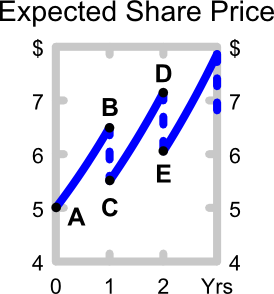

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

Between points D and E, the share price is expected to instantaneously fall by:

###C_2 = C_1.(1+\mathbf{g})^1###This is because the second dividend ##C_2## is expected to be equal to the first dividend ##C_1## grown by the dividend growth rate ##g##, not the total return ##r##.

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###P_0=\frac{d_1}{r-g}###

A stock pays dividends annually. It just paid a dividend, but the next dividend (##d_1##) will be paid in one year.

According to the DDM, what is the correct formula for the expected price of the stock in 2.5 years?

The growth rate in the dividend (##g##) must equal the growth rate in the stock price measured between a whole number of dividend periods. But the growth rate in stock price, also known as the capital return, is actually equal to the total return ##r## in between dividend payments. This is best seen in a saw-tooth graph, where the 'dividend drop-off' price fall can be seen every time a stock pays a dividend. But here it's explained in words:

- The expected capital return measured just after a dividend is paid to just after the next dividend is paid is ##g##.

- The expected capital return measured just before a dividend is paid to just before the next dividend is paid is also ##g##.

- But, the expected capital return measured just after a dividend is paid to just before the next dividend is paid is actually ##r##. The price growth must be higher than ##g## since the stock price must accumulate the next dividend payment as well as the usual price gain over a whole dividend period. Thus the price growth between dividend payments must be ##r = d_1/P_0 + g##.

Using this logic, the growth rate in the share price from just after the current (t=0) dividend was paid to just after the next dividend is paid in one year will be ##g##.

###P_\text{1, just after div} = P_\text{0, just after div}(1+g)^1### Similarly for the next year, just after that dividend is paid (at t=2).###\begin{aligned} P_\text{2, just after div} &= P_\text{1, just after div}(1+g)^1 \\ &= P_\text{0, just after div}(1+g)^2 \\ \end{aligned}###

But from just after the second dividend is paid at t=2 to t=2.5, that period is in between dividend payments, so the share price growth will be the total return ##r##.

###\begin{aligned} P_\text{2.5} &= P_\text{2, just after div}(1+r)^{0.5} \\ &= P_\text{0, just after div}(1+g)^2(1+r)^{0.5} \\ \end{aligned}###

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What would you call the expression ## C_1/P_0 ##?

For a stock, the expected income return is the ratio of the dividend expected to be paid in one year to the stock price now. Another name for it is the expected dividend yield.

Rearranging this equation:

###P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ### ###r_{\text{eff}} - g_{\text{eff}} = \frac{C_1}{P_{0}} ### ###r_{\text{eff}} = g_{\text{eff}} + \frac{C_1}{P_{0}} ###This is equivalent to:

###\begin{aligned} r_{\text{eff, total}} =& r_{\text{eff, capital}} + r_{\text{eff, income}} \\ \end{aligned} ###

Where ##r_{\text{eff, capital}} = g## and ##r_{\text{eff, income}} = d_1/p_0##.

The following is the Dividend Discount Model (DDM) used to price stocks:

###P_0=\dfrac{C_1}{r-g}###

If the assumptions of the DDM hold and the stock is fairly priced, which one of the following statements is NOT correct? The long term expected:

All statements are true except for answer c. The expected dividend yield is defined as ##c_1/p_0## whereas the expected growth rate in the dividend is ##g##.

Rearranging this equation:

###P_{0} = \dfrac{C_1}{r - g} ### ###r - g = \dfrac{C_1}{P_{0}} ### ###r = g + \dfrac{C_1}{P_{0}} ###This is equivalent to:

###\begin{aligned} r_{\text{total}} =& r_{\text{capital}} + r_{\text{income}} \\ \end{aligned} ###

Where ##r_{\text{capital}} = g## and ##r_{\text{income}} = C_1/P_0##. Note that the expected dividend yield can also be called the share's expected income return ##r_{\text{income}}##.

Question 497 income and capital returns, DDM, ex dividend date

A stock will pay you a dividend of $10 tonight if you buy it today. Thereafter the annual dividend is expected to grow by 5% pa, so the next dividend after the $10 one tonight will be $10.50 in one year, then in two years it will be $11.025 and so on. The stock's required return is 10% pa.

What is the stock price today and what do you expect the stock price to be tomorrow, approximately?

This question is interesting because it shows how the share price falls after the rights to the dividend detach from the share. Another way of looking at it is that higher dividends lead to lower share prices, all things remaining equal. At first glance it's a surprise that share prices fall due to dividends, but it makes sense because the money that the company had in its bank account is then paid to shareholders' bank accounts, so of course the company and its shares are worth less. Shareholders are not upset about this because they receive the money in their personal bank account.

If you buy the share today you will receive the dividend tonight, so the share price today will include the value of this dividend. There are two methods to calculate its price today:

Today's price method 1

Simply add the dividend tonight together with the perpetuity of payments which includes the dividend in one year, two years and so on forever.

###\begin{aligned} P_\text{0, today} &= C_0 + \dfrac{C_1}{r-g} \\ &= 10+ \dfrac{10 \times (1+0.05)^1}{0.1 - 0.05} \\ &= 10+ \dfrac{10.50}{0.05} \\ &= 10+ 210 \\ &= 220 \\ \end{aligned}###Today's price method 2

An alternative method which gives the same answer is to include the very first $10 received at time zero in the perpetuity, which will give a total value at time minus one, one period before the first cash flow at time zero. Then grow the value forward by one period using the total return: ###P_{-1} = \dfrac{C_0}{r-g} ### ###\begin{aligned} P_\text{0, today} &= P_{-1}.(1+r)^1 \\ &= \dfrac{C_0}{r-g}.(1+r)^1 \\ &= \dfrac{10}{0.1 - 0.05} \times (1+0.1)^1 \\ &= 200 \times 1.1 \\ &= 220 \\ \end{aligned}###

Tomorrow's approximate price

To find the price tomorrow, just after the $10 dividend tonight is paid, subtract the dividend received overnight from the price yesterday ##220 - 10 = 210##, or just calculate a perpetuity of payments starting in one year:

###\begin{aligned} P_\text{0, tomorrow} &= \dfrac{C_1}{r-g} \\ &= \dfrac{10 \times (1+0.05)^1}{0.1 - 0.05} \\ &= \dfrac{10.50}{0.05} \\ &= 210 \\ \end{aligned}###Tomorrow's exact price

While the answer to the question only asked for an 'approximate' price, we can calculate the exact expected price tomorrow. The stock price is expected to appreciate slightly overnight because the stock price increases by the total return between dividend payments. Examine the familiar saw-tooth diagram to see this. Assuming that there are 365 days in the year, then the price in one day, which is 1/365th or 0.002739726 of a year, should be:

###\begin{aligned} P_\text{1/365, tomorrow} &= \dfrac{C_1}{r-g}.(1+r)^{1/365} \\ P_\text{0.002739726, tomorrow} &= \dfrac{C_1}{r-g}.(1+r)^{0.002739726} \\ &= \dfrac{10 \times (1+0.05)^1}{0.1 - 0.05} \times (1+0.1)^{1/365} \\ &= 210.0548432 \end{aligned}###In the dividend discount model:

###P_0 = \dfrac{C_1}{r-g}###

The return ##r## is supposed to be the:

Future cash flows and returns are important.

Owners of assets such as shares are entitled to the future cash flows only, not the past cash flows which have already been paid. This is why asset prices are the present value of future cash flows.

To calculate the present value of future dividends, the dividend discount model must use the future expected return ##r## and growth rate ##g## of the market price of equity.

Of course the future is impossible to predict. Often the best guide to the future is the past, so in practice the actual historical return and growth rate are used as a proxy for what's expected in the future.

Market prices are important.

In finance, current market prices are always more important and relevant than old historical cost book prices. The market price of a share is the price that it trades for every day on the stock exchange. It's the price that a buyer will actually pay to buy the share.

When the share was first bought, the market price and book price were the same. But after that, the book price never changes while the market price goes up and down every day. Therefore the book price is old and out of date. Generally it is not the same as the current market price, unless by coincidence.

Owners equity recorded by an accountant in the firm's balance sheet is the sum of the shareholders' equity (also called contributed equity), retained profits and reserves such as asset revaluation reserve. This is often very different to the market price of equity. If the firm has been successful in the past, usually the market price of equity will be much higher than the book price.

Equity returns calculated from book prices are also therefore not very useful to determine value. They reflect the past, not the future. Therefore accounting ratios such as ROE (Net Income/Owners Equity) and ROA (Net Income/Total Assets) are not very useful for pricing stocks. But they are a reasonable guide to past performance.

A stock pays annual dividends which are expected to continue forever. It just paid a dividend of $10. The growth rate in the dividend is 2% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

The $10 dividend that was just paid (at t=0, a moment ago) in the past will not be paid to whoever buys the stock now, therefore it should be left out of the valuation. Every investment is priced based on its future cash flows, not past cash flows. Therefore, we're more interested in the next annual dividend ##C_1##, which will equal the old one ##C_0## grown by the growth rate: ##C_1 = C_0 (1+g)^1 = 10 \times (1+0.02)^1 = 10.2##

###\begin{aligned} P_{0} &= \frac{C_1}{r - g} \\ &= \frac{C_0(1+g)^1}{r - g} \\ &= \frac{10(1+0.02)^1}{0.1 - 0.02} = \frac{10.20}{0.08} = 127.5 \\ \end{aligned} ###

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in three and a half years (t = 3.5)?

###\begin{aligned} P_{3.5} =& \frac{C_4}{r-g} \times (1+r)^{0.5} \\ =& \frac{1.15}{0.1- 0.05} \times (1+0.1)^{0.5} \\ =& 23 \times (1+0.1)^{0.5} \\ =& 24.12260351 \\ \end{aligned} ###

Note that ## \frac{C_4}{r-g} ## is ## P_3 ##, and this amount is grown forward half a period by the total return (r), not the capital return (g). This may seem counter-intuitive since you would normally grow the dividend or the price forward by g. But in this case the stock price needs to be grown by the total return (r) because we are growing the price in between dividend payments. The stock price needs to grow by the higher total return so it is big enough to pay the dividend and fall in price, but still have realised a capital return (g).

Another way of thinking about it is that the growth rate in the stock price between t=3 and 3.5 needs to include not just the capital growth (g), but also the accrued dividend which will be paid at t=4 and which is part of the stock price until it is paid.

This concept is best illustrated by the 'saw-tooth' graph of expected share price vs time.

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_0 = \frac{d_1}{r - g} ###

Which expression is NOT equal to the expected dividend yield?

Answer (e) is incorrect because it grows the stock price by the total return (r) instead of the capital return (g). While it is true that in between dividend payments the stock price grows by the total return (r), the dividend payments reduce the stock price. This means that the stock price grows by the total return (r) less the dividend yield (##d_{t+1}/p_t##) which equals the capital return (g) over a whole period.

This concept is best illustrated in a 'saw-tooth' graph of expected share price versus time.

A fairly valued share's current price is $4 and it has a total required return of 30%. Dividends are paid annually and next year's dividend is expected to be $1. After that, dividends are expected to grow by 5% pa in perpetuity. All rates are effective annual returns.

What is the expected dividend income paid at the end of the second year (t=2) and what is the expected capital gain from just after the first dividend (t=1) to just after the second dividend (t=2)? The answers are given in the same order, the dividend and then the capital gain.

Since dividends are expected to grow in perpetuity and the share is fairly priced, the dividend discount model (DDM) applies. The dividends and share price will grow at the same rate of 5% pa. For an explanation of why see question 3.

Let the dividend cash flow be ##c##, the price be ##p##, the capital return be ##r_\text{capital}## and the total return be ##r_\text{capital}##.

###\begin{aligned} c_2 &= c_1(1+r_\text{capital})^1 \\ &= 1(1+0.05)^1 \\ &= 1.05 \\ \end{aligned}###To find the capital gain from just after the first dividend (t=1) to just after the second dividend (t=2), find the price increase between time 1 and 2.

###\begin{aligned} p_1 &= p_0(1+r_\text{capital})^1 \\ &= 4(1+0.05)^1 \\ &= 4.2 \\ \end{aligned}### ###\begin{aligned} p_2 &= p_0(1+r_\text{capital})^2 \\ &= 4(1+0.05)^2 \\ &= 4.41 \\ \end{aligned}###The capital gain is the price increase which is the difference between ##p_2## and ##p_1##. ###\begin{aligned} \text{Capital gain over second year} &= p_2 - p_1 \\ &= 4.41 - 4.2 \\ &= 0.21 \\ \end{aligned}###

Another method which gives the same expected share prices is to grow by the total return and subtract the dividends at the appropriate time.

###\begin{aligned} p_1 &= p_0(1+r_\text{total})^1 - c_1 \\ &= 4(1+0.3)^1 - 1 \\ &= 5.2 - 1 \\ &= 4.2 \\ \end{aligned}### ###\begin{aligned} p_2 &= \left( p_1 - c_1 \right)(1+r_\text{total})^1 - c_2 \\ &= \left( p_0(1+r_\text{total})^1 - c_1 \right)(1+r_\text{total})^1 - c_1(1+r_\text{capital})^1 \\ &= \left( 4(1+0.3)^1 - 1 \right)(1+0.3)^1 - 1(1+0.05)^1 \\ &= (5.2 - 1) \times 1.30 - 1.05 \\ &= 4.41 \\ \end{aligned}###Question 498 NPV, Annuity, perpetuity with growth, multi stage growth model

A business project is expected to cost $100 now (t=0), then pay $10 at the end of the third (t=3), fourth, fifth and sixth years, and then grow by 5% pa every year forever. So the cash flow will be $10.5 at the end of the seventh year (t=7), then $11.025 at the end of the eighth year (t=8) and so on perpetually. The total required return is 10℅ pa.

Which of the following formulas will NOT give the correct net present value of the project?

Answers a, b, c and d are all equivalent and give the same result: 44.73676041. Answer e is not the present value of the payments, it gives a result of 42.8683517. Answer e is very similar to answer a, but answer e discounts the annuity of the first three $10 payments by one too many years.

Answers a and b deal with the growing perpetuity in the same way by making the first perpetual cash flow the $10 at time 6. Because the perpetuity formula gives a value one year before the first cash flow, the value of the perpetuity is discounted by another 5 years.

Answers a and b differ in how they discount the three $10 payments at time 3, 4 and 5. Answer a uses the annuity formula to discount the three $10 payments which gives a value at time 2, one period before the first $10 cash flow at time 3. Then the value of the annuity is discounted by another 2 years. Answer b sums each cash flow's individual present value which gives the same result.

Answers c and d deal with the growing perpetuity in the same way by making the first perpetual cash flow the $10.50 at time 7. Because the perpetuity formula gives a value one year before the first cash flow, the value of the perpetuity is discounted by another 6 years.

Answers c and d differ in how they discount the four $10 payments at time 3, 4, 5 and 6. Answer c uses the annuity formula to discount the four $10 payments which gives a value at time 2, one period before the first $10 cash flow at time 3. Then the value of the annuity is discounted by another 2 years. Answer b sums each cash flow's individual present value which gives the same result.

When using the dividend discount model, care must be taken to avoid using a nominal dividend growth rate that exceeds the country's nominal GDP growth rate. Otherwise the firm is forecast to take over the country since it grows faster than the average business forever.

Suppose a firm's nominal dividend grows at 10% pa forever, and nominal GDP growth is 5% pa forever. The firm's total dividends are currently $1 billion (t=0). The country's GDP is currently $1,000 billion (t=0).

In approximately how many years will the company's total dividends be as large as the country's GDP?

Question 488 income and capital returns, payout policy, payout ratio, DDM

Two companies BigDiv and ZeroDiv are exactly the same except for their dividend payouts.

BigDiv pays large dividends and ZeroDiv doesn't pay any dividends.

Currently the two firms have the same earnings, assets, number of shares, share price, expected total return and risk.

Assume a perfect world with no taxes, no transaction costs, no asymmetric information and that all assets including business projects are fairly priced and therefore zero-NPV.

All things remaining equal, which of the following statements is NOT correct?

All statements are true except for statement b. BigDiv and ZeroDiv will have the same required total return into the future since returns are a proportional measure of performance. They are scaled by the starting price. Despite the fact that ZeroDiv's market value of assets, equity, share price, dividends and profit are expected to grow faster than BigDiv's, both firms' total returns will be equal to each other and unchanged through time.

Another point to note is that assets with equal risk should have equal expected total returns. Since the firms' risks are equal, their required total returns should also be equal.

Due to its higher dividends, BigDiv will have a lower capital return than ZeroDiv (statement a), and ZeroDiv's asset value and share price will grow faster than BigDiv's (statements c and d). This is because ZeroDiv will have more money available to re-invest in more assets to generate more money, whereas BigDiv won't since it pays out high dividends.

BigDiv has a higher payout ratio than ZeroDiv (statement e) because it pays higher dividends. ##\text{Payout ratio} = (\text{total dividends})/(\text{net income})##

A stock is expected to pay a dividend of $15 in one year (t=1), then $25 for 9 years after that (payments at t=2 ,3,...10), and on the 11th year (t=11) the dividend will be 2% less than at t=10, and will continue to shrink at the same rate every year after that forever. The required return of the stock is 10%. All rates are effective annual rates.

What is the price of the stock now?

Question 50 DDM, stock pricing, inflation, real and nominal returns and cash flows

Most listed Australian companies pay dividends twice per year, the 'interim' and 'final' dividends, which are roughly 6 months apart.

You are an equities analyst trying to value the company BHP. You decide to use the Dividend Discount Model (DDM) as a starting point, so you study BHP's dividend history and you find that BHP tends to pay the same interim and final dividend each year, and that both grow by the same rate.

You expect BHP will pay a $0.55 interim dividend in six months and a $0.55 final dividend in one year. You expect each to grow by 4% next year and forever, so the interim and final dividends next year will be $0.572 each, and so on in perpetuity.

Assume BHP's cost of equity is 8% pa. All rates are quoted as nominal effective rates. The dividends are nominal cash flows and the inflation rate is 2.5% pa.

What is the current price of a BHP share?

Method 1: Make two perpetuities.

Find the present value of the annual interim dividends and the annual final dividends as two separate perpetuities and add them together to get the share price.

###\begin{aligned} P_0 &= V_\text{0, perp of interim dividends} + V_\text{0, perp of final dividends} \\ &= \frac{C_\text{0.5, interim}}{r_\text{eff yrly} - g_\text{eff yrly}}(1+r_\text{eff yrly})^{0.5} + \frac{C_\text{1, final}}{r_\text{eff yrly} - g_\text{eff yrly}} \\ &= \frac{0.55}{0.08 - 0.04}(1+0.08)^{0.5} + \frac{0.55}{0.08 - 0.04} \\ &= 13.75(1+0.08)^{0.5} + 13.75 \\ &= 14.28941916 + 13.75 \\ &= 28.03941916 \\ \end{aligned}###

Note that nominal cash flows can be discounted by nominal discount rates to give a correct valuation without any problem. It is only important to discount nominal cash flows by nominal discount rates and real cash flows by real discount rates. Both methods should give the same answer.

Method 2: Single perpetuity of a year's payments.

Make a perpetuity out of the future value of the first interim dividend in 6 months plus the first annual dividend in one year. Use this dividend value inside the perpetuity with growth equation.

###\begin{aligned} P_0 &= \frac{C_{1\text{, dividends over first year}}}{r-g} \\ &= \frac{C_\text{0.5, interim dividend}(1+r)^{0.5} + C_\text{1, final dividend}}{r-g} \\ &= \frac{0.55(1+0.08)^{0.5} + 0.55}{0.08-0.04} \\ &= \frac{1.121576766}{0.08-0.04} \\ &= 28.03941916 \\ \end{aligned}###

Question 535 DDM, real and nominal returns and cash flows, stock pricing

You are an equities analyst trying to value the equity of the Australian telecoms company Telstra, with ticker TLS. In Australia, listed companies like Telstra tend to pay dividends every 6 months. The payment around August is called the final dividend and the payment around February is called the interim dividend. Both occur annually.

- Today is mid-March 2015.

- TLS's last interim dividend of $0.15 was one month ago in mid-February 2015.

- TLS's last final dividend of $0.15 was seven months ago in mid-August 2014.

Judging by TLS's dividend history and prospects, you estimate that the nominal dividend growth rate will be 1% pa. Assume that TLS's total nominal cost of equity is 6% pa. The dividends are nominal cash flows and the inflation rate is 2.5% pa. All rates are quoted as nominal effective annual rates. Assume that each month is exactly one twelfth (1/12) of a year, so you can ignore the number of days in each month.

Calculate the current TLS share price.

The stock price is the present value of future dividends, so the old dividends before now (March 2015) should be excluded. There are two method outlines below which give the same stock price.

Method 1: Make an annual perpetuity of each dividend and then grow the prices forward to March 2015

Make a perpetuity of the annual interim dividends in August. The next one is in August 2015. This will give a price one period before, in August 2014. This price can then be grown forward 7 months to the current time, March 2015.

###\begin{aligned} P_\text{Aug 2014, Aug dividends} &= \dfrac{C_\text{Aug 2015}}{r_\text{eff annual} - g_\text{eff annual}} \\ &= \dfrac{C_{\text{Aug }\mathbf{2014}}(1+g_\text{eff annual})^1}{r_\text{eff annual} - g_\text{eff annual}} \\ &= \dfrac{0.15(1+0.01)^1}{0.06 - 0.01} \\ &= 3.03 \\ \end{aligned}### ###\begin{aligned} P_\text{Mar 2015, Aug dividends} &= P_\text{Aug 2014, Aug dividends}(1+r_\text{eff annual})^{7/12} \\ &= 3.03(1+0.06)^{7/12} \\ &= 3.134760626 \\ \end{aligned}###Make a perpetuity of the annual interim dividends in February. The next one is in February 2016. This will give a price one period before, in February 2015. This price can then be grown forward 1 month to the current time, March 2015.

###\begin{aligned} P_\text{Feb 2015, Feb dividends} &= \dfrac{C_\text{Feb 2016}}{r_\text{eff annual} - g_\text{eff annual}} \\ &= \dfrac{C_{\text{Feb }\mathbf{2015}}(1+g_\text{eff annual})^1}{r_\text{eff annual} - g_\text{eff annual}} \\ &= \dfrac{0.15(1+0.01)^1}{0.06 - 0.01} \\ &= 3.03 \\ \end{aligned}### ###\begin{aligned} P_\text{Mar 2015, Feb dividends} &= P_\text{Feb 2015, Feb dividends}(1+r_\text{eff annual})^{1/12} \\ &= 3.03(1+0.06)^{1/12} \\ &= 3.044748678 \\ \end{aligned}###Note that in both cases the share price is grown forward by the total required return ##r_\text{eff annual}##, not the growth rate ##g_\text{eff annual}##. This is because in the perpetuity equation, share prices rise by the total return between dividend payments. This is apparent when looking at the 'saw-tooth' graph of expected stock prices.

The sum of the two perpetuities will give the total current share price in March 2015. It's OK to sum them since they are both at the same time.

###\begin{aligned} P_\text{Mar 2015, All Aug and Feb dividends} &= P_\text{Mar 2015, Aug dividends} + P_\text{Mar 2015, Feb dividends} \\ &= 3.134760626 + 3.044748678 \\ &= 6.179509305 \\ \end{aligned}###Method 2: Grow the dividends forward to March 2016, add them together and then make a single annual perpetuity

Note that this method is not a good way to conceptualise how stock pricing works since it doesn't make sense to artificially move dividends backward and forward. It can't be visualised on the saw-tooth graph of expected stock prices. This method only works because growing the dividends forward is mathematically equivalent to growing the price forward like we did in method 1. At the end of this explanation, the equivalence of the methods will be discussed.

Since both the interim and final dividend grow forever and at the same rate, we can combine them in the one perpetuity equation. So we'll grow the dividends forward one year ahead of the current time, which gives ##C_1## in Mar 2016, so the perpetuity equation will give us the current price, ##P_0## in Mar 2015.

###\begin{aligned} \left( \begin{array}{c} \text{Aug 2015 final dividend} \\ \text{grown forward to Mar 2016} \end{array} \right) &= C_\text{Aug 2015}(1+r_\text{eff annual})^{7/12} \\ &= C_{\text{Aug }\mathbf{2014}}(1+g_\text{eff annual})^1(1+r_\text{eff annual})^{7/12} \\ &= 0.15(1+0.01)^1(1+0.06)^{7/12} \\ &= 0.156738031 \\ \end{aligned}### ###\begin{aligned} \left( \begin{array}{c} \text{Feb 2016 final dividend} \\ \text{grown forward to Mar 2016} \end{array} \right) &= C_\text{Feb 2016}(1+r_\text{eff annual})^{1/12} \\ &= C_{\text{Feb }\mathbf{2015}}(1+g_\text{eff annual})^1(1+r_\text{eff annual})^{1/12} \\ &= 0.15(1+0.01)^1(1+0.06)^{1/12} \\ &= 0.152237434 \\ \end{aligned}### ###\begin{aligned} P_\text{0, Mar 2015} &= \dfrac{ \left( \begin{array}{c} \text{Feb 2015 dividend grown} \\ \text{forward to Mar 2016} \end{array} \right) + \left( \begin{array}{c} \text{Aug 2014 dividend grown} \\ \text{forward to Mar 2016} \end{array} \right) }{ r_\text{eff annual} - g_\text{eff annual} } \\ &= \dfrac{0.156738031+0.152237434}{0.06 - 0.01} \\ &= \dfrac{0.308975465}{0.06 - 0.01} \\ &= 6.179509305 \\ \end{aligned}###Here in method 2, the next August 2015 dividend was multiplied by ##(1+r_\text{eff annual})^{7/12}##. In method 1, the annual August dividends were priced, and this price was multiplied by ##(1+r_\text{eff annual})^{7/12}##.

Similarly for the February dividend and price in method 1 and 2 respectively, both were multiplied by ##(1+r_\text{eff annual})^{1/12}##. Because multiplying a perpetuity price is equivalent to multiplying the perpetuity's dividend, both methods give the same result. This is why method 2 works, it's due to a mathematical trick that multiplication of the price is equivalent to multiplication of the dividend. Even though in reality, it's only the price which grows by the total return between dividend payments, as can be seen in the saw-tooth graph of stock prices.

Method 1 summary: Make an annual perpetuity of each dividend and then grow the prices forward to March 2015.

###\begin{aligned} P_\text{Mar 2015} &= \dfrac{C_\text{Aug 2015}}{r_\text{eff annual} - g_\text{eff annual}}(1+r_\text{eff annual})^{7/12} + \dfrac{C_\text{Feb 2016}}{r_\text{eff annual} - g_\text{eff annual}}(1+r_\text{eff annual})^{1/12} \\ \end{aligned}###Method 2 summary: Grow the dividends forward to March 2016.

###\begin{aligned} P_\text{Mar 2015} &= \dfrac{C_\text{Aug 2015}(1+r_\text{eff annual})^{7/12}}{r_\text{eff annual} - g_\text{eff annual}} + \dfrac{C_\text{Feb 2016}(1+r_\text{eff annual})^{1/12}}{r_\text{eff annual} - g_\text{eff annual}} \\ \end{aligned}###